FinCEN Issues Compliance Guide to Help Small Businesses Report Beneficial Ownership Information

The Financial Crimes Enforcement Network (FinCEN) published a Small Entity Compliance Guide to assist the small business community in complying with the beneficial ownership information (BOI) reporting rule. Starting in 2024, many entities created in, or registered to do business in, the United States will be required to report to FinCEN information about their beneficial owners—the individuals who ultimately own or control a company. The Guide is intended to help businesses learn about and comply with the new reporting requirements. FinCEN is also issuing revised and new FAQs about the BOI reporting requirements that incorporate content from the Guide. Additional translated versions of the Guide and the FAQs will be posted to FinCEN’s website soon.

PayPal Launches New Stablecoin

PayPal’s Real Stablecoin Strategy: It Wants to Earn Interest on Your Deposits. While it seems positive for crypto, the PYUSD stablecoin will benefit PayPal’s own coffers most of all

Congresswoman Maxine Waters Says She’s Deeply Concerned About PayPal’s New Stablecoin

SR 23-7: Creation of Novel Activities Supervision Program

The Federal Reserve has established a Novel Activities Supervision Program (Program) to enhance the supervision of novel activities conducted by banking organizations supervised by the Federal Reserve. The Program will focus on novel activities related to crypto-assets, distributed ledger technology (DLT), and complex, technology-driven partnerships with nonbanks to deliver financial services to customers. The Program will be risk-focused and complement existing supervisory processes, strengthening the oversight of novel activities conducted by supervised banking organizations.

Applicability: This letter applies to all banking organizations supervised by the Federal Reserve, including those with $10 billion or less in consolidated assets.

Crypto industry faces new pressure from anti-money laundering regulations

A bipartisan group of senators on Wednesday introduced an amendment to the National Defense Authorization Act (NDAA) that includes new anti-money laundering provisions for the crypto industry.

Sens. Kirsten Gillibrand (D-N.Y.) and Cynthia Lummis (R-Wyo.), Elizabeth Warren (D-Mass.) and Roger Marshall (R-Kan.), have teamed up to put forward the proposal, geared at preventing the use of crypto assets in illicit financial transactions, in an amendment to annual legislation the that sets the budget for the nation’s armed forces.

Bipartisan U.S. Senators Unveil Crypto Anti-Money Laundering Bill to Stop Illicit Transfers

WASHINGTON – In an effort to prevent money laundering and stop crypto-facilitated crime and sanctions violations, a leading group of U.S. Senators is introducing new, bipartisan legislation requiring decentralized finance (DeFi) services to meet the same anti-money laundering (AML) and economic sanctions compliance obligations as other financial companies, including centralized crypto trading platforms, casinos, and even pawn shops. The legislation also modernizes key Treasury Department anti-money laundering authorities, and sets new requirements to ensure that “crypto kiosks” don’t become a vector for laundering the proceeds of illicit activities.

US SEC charges crypto platform Coinbase, one day after suing Binance

SEC Charges Coinbase for Operating as an Unregistered Securities Exchange, Broker, and Clearing Agency. Coinbase also charged for the unregistered offer and sale of securities in connection with its staking-as-a-service program.

According to the SEC’s complaint, since at least 2019, Coinbase has made billions of dollars unlawfully facilitating the buying and selling of crypto asset securities. The SEC alleges that Coinbase intertwines the traditional services of an exchange, broker, and clearing agency without having registered any of those functions with the Commission as required by law. Through these unregistered services, Coinbase allegedly:

- Provides a marketplace and brings together the orders for securities of multiple buyers and sellers using established, non-discretionary methods under which such orders interact;

- Engages in the business of effecting securities transactions for the accounts of Coinbase customers; and

- Provides facilities for comparison of data respecting the terms of settlement of crypto asset securities transactions, serves as an intermediary in settling transactions in crypto asset securities by Coinbase customers, and acts as a securities depository.

As alleged in the SEC’s complaint, Coinbase’s failure to register has deprived investors of significant protections, including inspection by the SEC, recordkeeping requirements, and safeguards against conflicts of interest, among others.

The SEC’s complaint also alleges that Coinbase’s holding company, Coinbase Global Inc. (CGI), is a control person of Coinbase and is thus also liable for certain of Coinbase’s violations.

Read SEC Press Release

SEC sues Binance and CEO Changpeng Zhao for U.S. securities violations

Washington D.C., June 5, 2023 —

The Securities and Exchange Commission today charged Binance Holdings Ltd. (“Binance”), which operates the largest crypto asset trading platform in the world, Binance.com; U.S.-based affiliate, BAM Trading Services Inc. (“BAM Trading”), which, together with Binance, operates the crypto asset trading platform, Binance.US; and their founder, Changpeng Zhao, with a variety of securities law violations.

Among other things, the SEC alleges that, while Zhao and Binance publicly claimed that U.S. customers were restricted from transacting on Binance.com, Zhao and Binance in reality subverted their own controls to secretly allow high-value U.S. customers to continue trading on the Binance.com platform. Further, the SEC alleges that, while Zhao and Binance publicly claimed that Binance.US was created as a separate, independent trading platform for U.S. investors, Zhao and Binance secretly controlled the Binance.US platform’s operations behind the scenes.

The SEC also alleges that Zhao and Binance exercise control of the platforms’ customers’ assets, permitting them to commingle customer assets or divert customer assets as they please, including to an entity Zhao owned and controlled called Sigma Chain. The SEC’s complaint further alleges that BAM Trading and BAM Management US Holdings, Inc. (“BAM Management”) misled investors about non-existent trading controls over the Binance.US platform, while Sigma Chain engaged in manipulative trading that artificially inflated the platform’s trading volume. Further, the Complaint alleges that the defendants concealed the fact that it was commingling billions of dollars of investor assets and sending them to a third party, Merit Peak Limited, that is also owned by Zhao.

Read SEC Press Release

Binance leaves Canada due to stricter crypto rules

Canadians will no longer have access to the largest cryptocurrency exchange in the world. Binance has announced that it’s withdrawing from the Canadian marketplace due to new stablecoin and investor limits in the country. Back in February, the Canadian Securities Administrators (CSA) released new guidance that gives crypto trading platforms operating in the region 30 days to register or to leave. The crypto firms that decide to register and stay will have to adhere to stricter rules, such as seeking the CSA’s approval before allowing users to buy or deposit stablecoins.

Read Engadet Article

US DOJ to crackdown on crypto exchanges, NCET director says

With the novel crackdown on crypto firms, the DOJ aims to ramp up this scrutiny, sending a “deterrent message” to businesses that have been able to avoid anti-money laundering or client identification rules, and who were not investing in solid compliance and risk mitigation procedures, Choi said.

The NCET director, without naming any specific entity, said that a company’s size “is not something that the department will countenance” while weighing potential charges.

The Justice Department will also focus on crimes related to decentralised finance, particularly “chain bridges”, where users can exchange different types of digital tokens, or nascent projects with codes that are vulnerable to such attacks, she added.

Former Coinbase Insider Sentenced In First Ever Cryptocurrency Insider Trading Case

Ishan Wahi Was Sentenced to Two Years in Prison for Tipping His Associates Regarding Crypto Assets That Were Going to be Listed on Coinbase Exchanges.

New York Attorney General Proposes Nation-Leading Regulations on Cryptocurrency Industry

NEW YORK – New York Attorney General Letitia James today announced landmark legislation to tighten regulations on the cryptocurrency industry to protect investors, consumers, and the broader economy. The multi-billion-dollar industry lacks robust regulations, making it prone to dramatic market fluctuations, and has been used to hide and facilitate criminal conduct and fraud. Attorney General James’ program bill, which proposes the strongest and most comprehensive set of regulations on cryptocurrency in the nation, would increase transparency, eliminate conflicts of interest, and impose commonsense measures to protect investors, consistent with regulations imposed on other financial services.

The bill would require independent public audits of cryptocurrency exchanges and prevent individuals from owning the same companies, such as brokerages and tokens, to stop conflicts of interest. Crypto platforms would also have responsibilities to customers similar to banks under the federal Electronic Fund Transfer Act by requiring platforms to reimburse customers who are the victims of fraud. The bill would also strengthen the New York State Department of Financial Services’ (DFS) regulatory authority of digital assets.

Treasury Department Announces 2023 De-Risking Strategy

The U.S. Department of the Treasury issued the 2023 De-risking Strategy, as mandated by Congress in the Anti-Money Laundering Act of 2020. The first of its kind, the Strategy examines the phenomenon of financial institutions de-risking and its causes, and it identifies those greatest impacted. It also offers recommended policy options to combat it.

BitFlyer Slapped With a $1.2 Million Fine

The New York State Department of Financial Services (NYDFS) ordered the cryptocurrency exchange BitFlyer USA to pay a $1.2 million fine for not abiding by the state’s cybersecurity regulations. The financial regulator said BitFlyer USA failed to meet the state’s cybersecurity regulation, despite having a license to operate in New York.

NY State Senate Holds Hearing on Crypto and FinTech Regulation and Legislation

On April 25th, 2023, the New York State Senate held a public hearing to educate legislators and the public on cryptocurrency, discuss regulation of FinTech companies, and discuss FinTech licensing legislation.

House Subcommittees Hold Simultaneous Hearings on Regulation

Coinbase Sues the SEC

Coinbase initially sought regulatory clarification from the Securities and Exchange Commission (SEC) in July 2022 via a Petition for Rulemaking, asking the SEC to use its formal rulemaking process to provide guidance for the crypto industry. On April 24, 2023, Coinbase took legal action against the SEC, asking a federal judge to force the SEC to espond yes or no to Coinbase’s July 2022 petition.

SEC’s Gary Gensler responded by saying ‘the law is clear’ for crypto exchanges and that they must comply with regulators. The SEC is trying to make clear that there’s no ambiguity in the rules.

On May 4, 2023, U.S. Court Orders SEC to Respond to Coinbase Allegations Within 10 Days

Coinbase Petition for Rulemaking

FinCEN Issues an Enforcement Action Against a Trust Charter

The Financial Crimes Enforcement Network has assessed a $1.5 million civil money penalty on South Dakota-chartered The Kingdom Trust Company (Kingdom Trust) for willful violations of the Bank Secrecy Act (BSA) and its implementing regulations. This is FinCEN’s first enforcement action against a trust company.

Kingdom Trust, a South Dakota trust company, has been subject to FinCEN’s Suspicious Activity Reporting (SAR) regulation since it commenced operations. Certain financial institutions operating in the United States, which includes not only banks and trust charters but also money services businesses, are subject to the SAR regulation.

Factors contributing to the deficiencies included the below…are you at risk to repeat the same mistakes?

Kingdom Trust personnel with AML responsibilities have acknowledged not fully understanding federal SAR filing requirements and that they may have missed important information about some of their riskiest clients as the result of maintaining other, non-AML responsibilities.

Kingdom Trust relied on a manual review of daily transactions by a single employee to identify potentially suspicious transactions and activity at various points throughout the Relevant Time Period

The Financial Technology Protection Act Reintroduced

On April 27th, 2023, the Financial Technology Protection Act co-sponsored by Senators Kirsten Gillibrand (D-N.Y.) and Ted Budd (R-N.C.) and Congressmen Zachary Nunn (R-Iowa) and Jim Himes (D-Conn.) that was initially introduced in January 2021, was reintroduced. The bill proposes to establish an Independent Financial Technology Task Force to Combat Terrorism and Illicit Financing, to provide rewards for information leading to convictions related to terrorist use of digital currencies, to establish a FinTech Leadership in Innovation and Financial Intelligence Program to encourage the development of tools and programs to combat terrorist and illicit use of digital currencies, and for other purposes.

The bill was introduced ahead of a trio of hearings hosted by Financial Services Committee subcommittees and a House Agriculture Committee subcommittee, all focused on crypto or illicit finance. The bill does not get into the broader conversation in Congress about how crypto should be regulated. Nunn noted that there’s still jurisdictional questions between the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC), each of which reports to a different Congressional committee

Financial Technology Protection Act

Coindesk – Reintroduced Congressional Bill Would Call for Feds to Study Terrorist Uses for Crypto

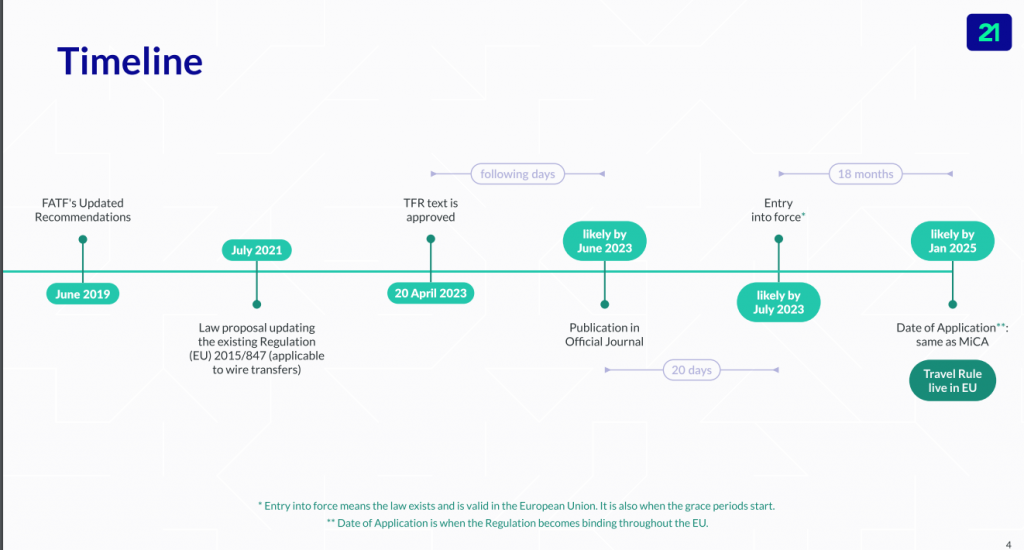

EU’s MiCA and Transfer of Funds Regulation Approved

On April 20th 2023, Members of the European Parliament voted to approve the EU’s Markets in Crypto-Assets Regulation (MiCA) as well as the Transfer of Funds (TFR) regulation The new rules come into effect over the next two years.

FATF Virtual Assets Contact Group (VACG): 21’s Takeaways

The Financial Action Task Force’s (FATF) Virtual Assets Contact Group recently held a meeting in Tokyo to discuss the challenges and progress made in regulating virtual assets worldwide. The Group stressed that countries worldwide need to urgently implement the FATF Standards to effectively regulate and supervise this sector.

FDIC and FRB Release Reports on Bank Failures

FDIC Releases Report Detailing Supervision of the Former Signature Bank, New York, New York

This detailed analysis identifies clearly that “the root cause of Signature Bank’s failure was poor management. Signature Bank’s board of directors and management pursued rapid, unrestrained growth without developing and maintaining adequate risk management practices and controls appropriate for the size, complexity and risk profile of the institution. Signature Bank’s management did not prioritize good corporate governance practices, did not always heed FDIC examiner concerns, and was not always responsive or timely in addressing FDIC supervisory recommendations (SRs). Signature Bank funded its rapid growth through an over reliance on uninsured deposits without implementing fundamental liquidity risk management practices and controls.”

Review of the Federal Reserve’s Supervision and Regulation of Silicon Valley Bank

Silicon Valley Bank (SVB) failed because of a textbook case of mismanagement by the bank. Its senior leadership failed to manage basic interest rate and liquidity risk. Its board of directors failed to oversee senior leadership and hold them accountable. And Federal Reserve supervisors failed to take forceful enough action, as detailed in the report.

Mastercard Launches Crypto Credential Service for Cross-Border Transfers

In this first cross-border use case, the Mastercard Crypto Credential service, announced Friday by Raj Dhamodharan from the stage at Consensus 2023, allows wallets to be identified in transactions that are compliant with requirements such as the Financial Action Task Force’s (FATF) “travel rule.”

OFAC settles with Poloniex

Poloniex, LLC, a Delaware company with its principal place of business in Boston, Massachusetts that operated an online trading and settlement platform previously doing business as Poloniex Inc. (hereinafter collectively “Poloniex”) has agreed to remit $7,591,630 to settle its potential civil liability for 65,942 apparent violations of multiple sanctions programs. Between January 2014 and November 2019, the Poloniex trading platform allowed customers apparently located in sanctioned jurisdictions to engage in online digital asset-related transactions— consisting of trades, deposits, and withdrawals—with a combined value of $15,335,349, despite having reason to know their location based on both Know Your Customer information and internet protocol address data. The settlement amount reflects OFAC’s determination that Poloniex’s apparent violations were not voluntarily self-disclosed and were not egregious.